National Economic Impact Study of the Debt Resolution Industry

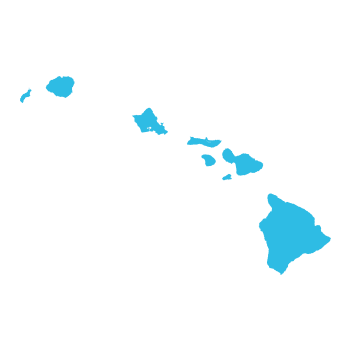

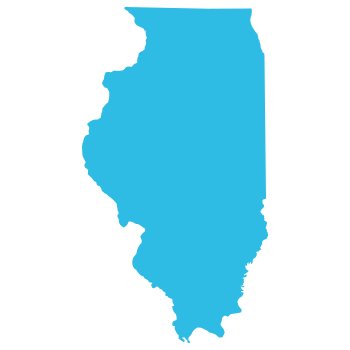

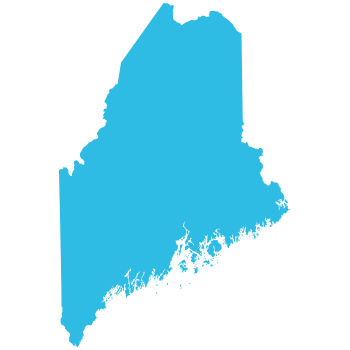

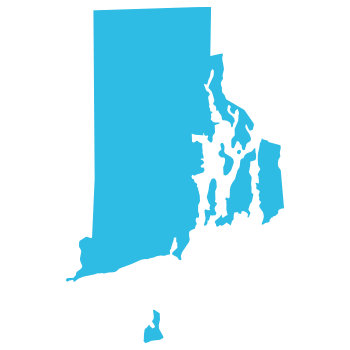

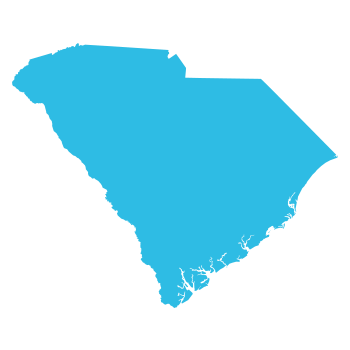

Scroll over each state using the interactive map above to see the debt resolution industry’s local economic impact.

In 2019, the predecessor to the American Association for Debt Resolution (AADR), the American Fair Credit Council (AFCC), commissioned a first-of-its-kind research study to assess the national economic impact of debt resolution activity. The AADR recently released the third edition of the Economic Impact Report, and its data confirms that the debt resolution industry provides a vital option, giving Americans in desperate financial situations a path back to financial wellness. To read this report, click the Download Report button.

*Estimated total economic impact if debt resolution is widely available in these states

About the 2023 Economic Impact Report

After releasing an extensive study of the debt resolution industry and its vast contributions to the economies of dozens of states and the United States, the AADR commissioned the third report in its series of independent research studies to assess the national economic impact of debt resolution activity. Using the same research firm, John Dunham & Associates (JDA), data was collected from across the United States to illustrate the debt resolution industry’s substantial positive impact on the U.S. economy and the hundreds of thousands of Americans who have taken advantage of debt resolution.1

The debt resolution industry contributes to the American economy in various ways, three of which are particularly profound. First, the industry employs thousands of Americans nationwide. Second, creditors participating in the debt resolution process receive funds from debtors faster than they would otherwise. Finally, and most importantly, consumers with crippling unsecured debt enrolled in debt resolution programs are able to get back on their feet rapidly and once again contribute positively to their local economies.2

- $8.3 billion in total economic impact.3

- $5.6 billion in total principal value.4

- 1.2 million individual settled accounts.5

- Consumers saved $1.8 billion.6

The Current Economic Impact Delivered by the Debt Resolution Industry

The debt resolution industry contributes to the U.S. economy in a variety of ways each year, accounting for a total economic impact of $8.3 billion in 2022.7

This impact is realized across business and personal interests extensively:

- Indebted Americans saved $1.8 billion.8

- Creditors participating in debt resolution programs received more than $2.8 billion.9

- The industry was cumulatively responsible for nearly 32,000 jobs.10

- The industry paid more than $560 million in federal, state and local taxes.11

The Potential Economic Impact Delivered by Debt Resolution in 18 Additional States

The study also examined the potential economic impact of the debt resolution industry if consumers in the 18 states where debt resolution is currently not widely available were given the opportunity to take advantage of these services. That resulting economic impact in the U.S. annually would total an additional estimated $2.1 billion more, with about 7,700 additional jobs and $488 million more in savings for consumers.12

- $2.1 billion

Additional Economic Impact - $488 million

More in Consumer Savings

$2.1 billion

Additional Economic Impact

$488 million

More in Consumer Savings

The resulting study report and data confirms debt resolution companies provide a vital service, giving Americans in desperate financial situations a path back to financial wellness. The debt resolution industry serves as an advocate for consumers and it delivers billions in economic benefits, supports thousands of U.S. jobs, and enables creditors to receive payments on outstanding debt, in situations where they would not have benefitted otherwise.

To view the full report, click here.

Footnotes:

- Dunham. (2023). 2023 Economic Impact of the Debt Settlement Industry (2023). Page 6.

- Dunham. (2023). 2023 Economic Impact. Page 9.

- Dunham. (2023). 2023 Economic Impact. Page 2.

- Dunham. (2023). 2023 Economic Impact. Page 6.

- Dunham. (2023). 2023 Economic Impact. Page 6.

- Dunham. (2023). 2023 Economic Impact. Page 13.

- Dunham. (2023). 2023 Economic Impact. Page 2.

- Dunham. (2023). 2023 Economic Impact. Page 13.

- Dunham. (2023). 2023 Economic Impact. Page 12.

- Dunham. (2023). 2023 Economic Impact. Page 3.

- Dunham. (2023). 2023 Economic Impact. Page 3.

- Dunham. (2023). 2023 Economic Impact. Page 10.